Services

Asset Management

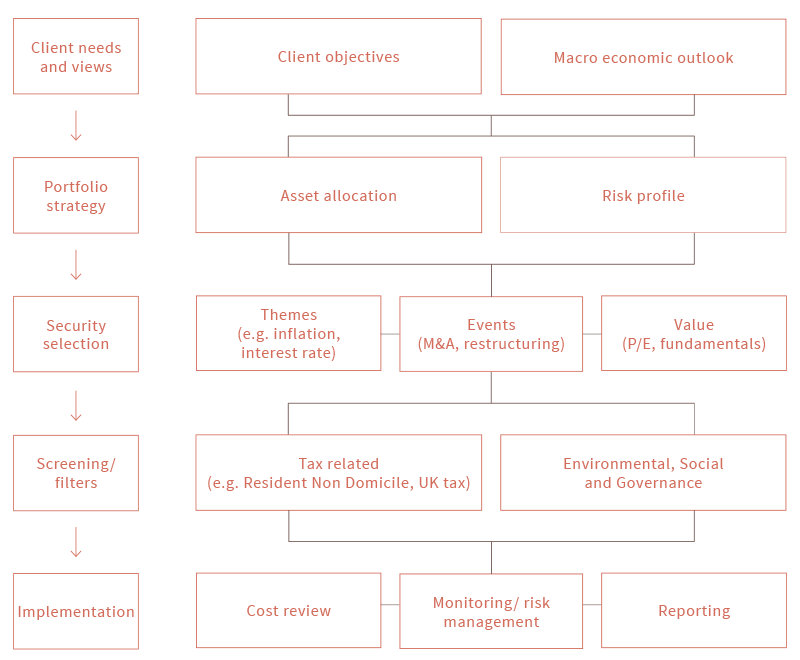

OUR CLIENTS BENEFIT FROM AN INSTITUTIONAL QUALITY ASSET MANAGEMENT OFFERING, AND A BESPOKE ASSET ALLOCATION DESIGNED AROUND THEIR OBJECTIVES, TIMELINES AND RISK APPETITE

We aim to generate strong risk adjusted returns by investing in liquid and listed securities across asset classes.

We invest in securities which we believe are under-priced and/ or are expected to appreciate due to a catalyst including regulatory changes, change in business model, post-bankruptcy or a corporate event such as restructuring, capitalisation or spin-off. Risk management and scenario analysis underpin all our investment decisions.

Investment Philosophy

Capital preservation under all market conditions

Delivery of consistent returns through diversification by asset class and geographies

Value and event driven investing and bottom-up analysis

Direct, single line trades where possible, to avoid layers of fees

Our Approach

IDEA GENERATION

IDENTIFICATION OF DISLOCATION

INVESTMENT HYPOTHESIS

MONITOR INVESTMENT

Investment Process

Risk Management

Discipline Enforced by risk limits

Portfolio stop losses and other risk limits

Scenario Analysis

Part of our investment process

Catalyst Driven Investing

Knowing when we are proven wrong

Ways of Trading

Thematic Trades

Top-down approach with a focus on broader macroeconomic themes, used to identify strong companies and securities

Event-Driven Trades

We exploit pricing inefficiencies based on a corporate event, such as M&A, spinoff regulatory changes or earnings

Value-Driven Trades

We select securities which we believe are trading at less than their long-term value

Services

Debt Financing

We provide bespoke finance solutions from both our own funding line, institutional lenders and banks across the UK and Europe

We are experts in funding Super-Prime Residential, Commercial Investment and Large Development Projects across the UK. We have access to over 100 banks, funds and private lenders that can accommodate most borrowing requirements. Our experience and close relationships with these lenders enable us to source solutions to even the most complex of needs and negotiate the best terms on our clients’ behalf.

VAR also offers loan facilities directly from our own funding. On occasions where standard bank funding is unavailable, we fund loans of up to £10m, with a maximum 24 month term, secured by both residential and commercial UK assets. Please contact us for terms regarding a specific enquiry.

Services

Corporate Advisory and Private Capital

At VAR Capital, we offer comprehensive corporate finance advisory services, leveraging our extensive expertise and global network to guide you through critical business transactions.

Our seasoned team excels in:

– Mergers & Acquisitions (Buy-side and Sell-side)

– Capital Raising (Debt and Equity)

– Corporate Restructuring and Refinancing

VAR Capital also offers exclusive access to curated private capital investment opportunities, focusing on the underserved mid-market. Our approach is tailored for clients and long-term investors seeking strategic, value-driven investments.

Key features of our Private Capital investment service:

– Proprietary Deal Flow: Access to unique, off-market opportunities

– Long-Term Perspective: Aligning with patient capital for sustainable growth

– Agile Decision-Making: Swift execution when opportunities arise

– Aligned Interests: Co-investment alongside our clients

– Flexible Investment Structures: Including management investment vehicles and managed accounts

Contact

41 & 43, Maddox Street

Mayfair, London

W1S 2PD

+44 207 0960 790

VAR Capital Ltd is a limited company incorporated in England and Wales with registration number 09159540. UK registered office 41 & 43, Maddox Street, Mayfair, London W1S 2PD. VAR Capital Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Firm reference number 718558. VAR Capital is a trademark of VAR Capital Limited under the UK intellectual property regulation. Trademark number: UK00003429839